sales tax oklahoma tulsa ok

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. An example of an item that exempt from Oklahoma is prescription medication.

Sapulpa OK Sales Tax Rate.

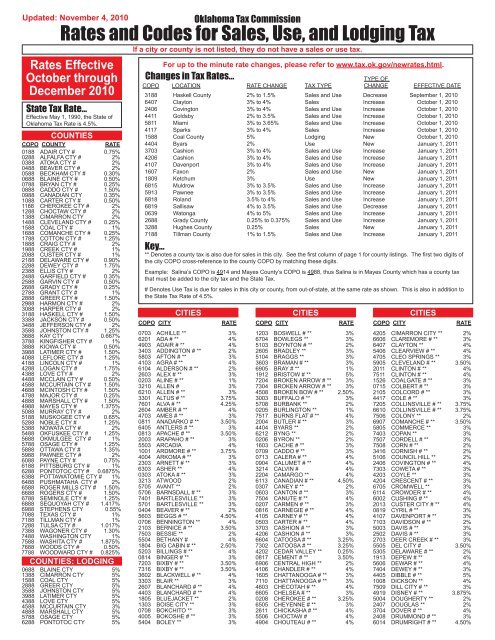

. City salesuse tax copo city rate city salesuse tax copo city rate county salesuse tax. See reviews photos directions phone numbers and more for Oklahoma Sales Tax locations in Tulsa OK. The December 2020 total local sales tax rate was also 4867.

This is the total of state county and city sales tax rates. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. Stillwater OK Sales Tax Rate.

Tulsa OK Sales Tax Rate. Sand Springs OK Sales Tax Rate. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Our office hours are 800 am. Owasso OK Sales Tax Rate. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766.

Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The City has five major tax categories and collectively they provide 52 of the projected revenue. Oklahoma tax commission 0188 adair cty 175 0288 alfalfa cty 2.

Average Sales Tax With Local. Tulsa OK Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. 4334 NW Expressway Suite 183 Oklahoma City OK 73116 Phone. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax.

The December 2020 total local sales tax rate was also 8517. The current total local sales tax rate in Tulsa County OK is 4867. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The Tulsa Sales Tax is collected by the merchant on. The current total local sales tax rate in Tulsa OK is 8517.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. The Tulsa County sales tax rate is. To review the rules in Oklahoma visit our state-by-state guide.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. State of Oklahoma - 45.

The Tulsa County Sales Tax is collected by the. Sales tax at 365 2 to general fund. Sales Tax in Tulsa.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. There is no applicable special. 7288 tulsa cty 0367 7388 wagoner cty 130 7488 washington cty 1 7588 washita cty 2.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The Oklahoma state sales tax rate is currently. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but an individual who owns a store.

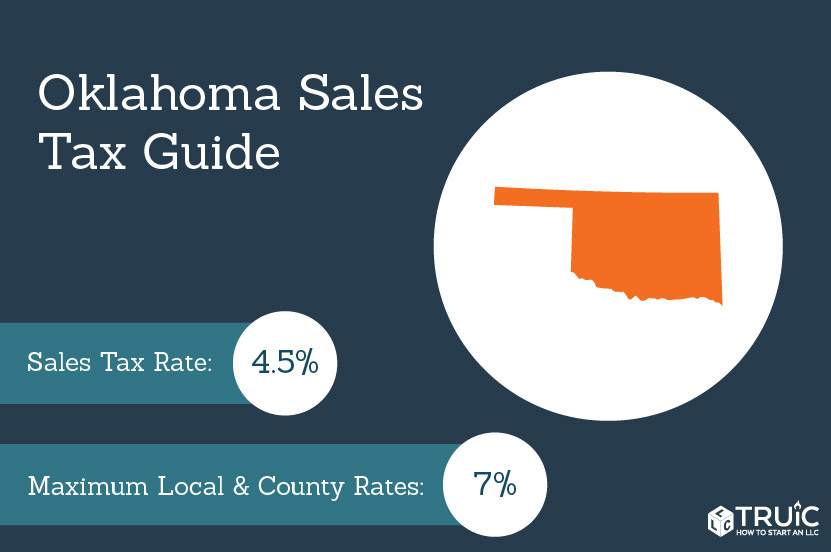

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

31 rows Norman OK Sales Tax Rate. Ponca City OK Sales Tax Rate. The current total local sales tax rate in Tulsa OK is 8517.

Tulsa County - 0367. The Tulsa sales tax rate is. 7288 TULSA CTY 0367 7388 WAGONER CTY 130 7488 6610 WASHINGTON CTY 0409 1 7588 WASHITA CTY 2 7688 WOODS CTY 050 7788 WOODWARD CTY 090 Rates and Codes for Sales Use and Lodging Tax 4705 Cleo Springs 3 Use New January 1 2022 5507 Edmond 375 to 4 Sales and Use Increase January 1 2022.

OKLAHOMA CITY The Oklahoma Supreme Court on Thursday ruled that a 125 percent sales tax on vehicles was not a tax increase because it only removed an exemption. Shawnee OK Sales Tax Rate. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. The Tulsa County Sales Tax is 0367. There are a total of 355 local tax jurisdictions across the state collecting an average local tax of 3201.

Oklahoma City OK Sales Tax Rate. This is the total of state and county sales tax rates. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle purchases.

The 2018 United States Supreme Court decision in South Dakota v. Tulsa County OK Sales Tax Rate. The Oklahoma sales tax rate is currently.

The current total local sales tax rate in Tulsa OK is 8517. For vehicles that are being rented or leased see see taxation of leases and rentals. The County sales tax rate is.

Total Sales Tax Per Dollar By City Oklahoma Watch

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma Sales Tax Small Business Guide Truic

State And Local Tax Distribution Oklahoma Policy Institute

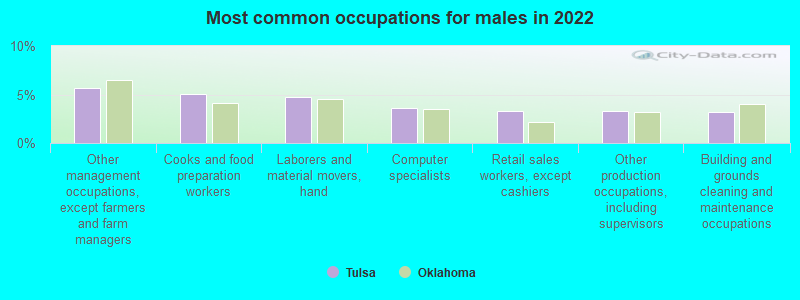

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Should Oklahoma Broaden The Sales Tax To More Services Oklahoma Policy Institute

Oklahoma S Tax Mix Oklahoma Policy Institute

How Oklahoma Taxes Compare Oklahoma Policy Institute

Taxes Broken Arrow Ok Economic Development

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Oklahoma Tax Commission Linkedin

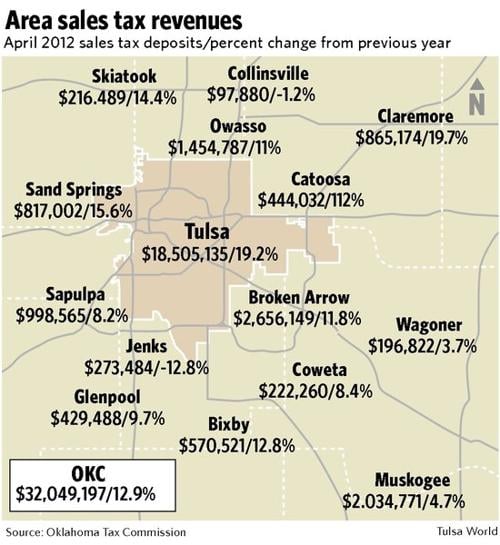

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries